New Jersey Future Blog

With Recession in the Forecast, How Prepared is NJ’s Economy for Upcoming Rain?

July 20th, 2023 by Michael Atkins

Jeffrey Otteau, Managing Partner & Chief Economist, Otteau Group Inc.

As the world slowly but surely emerges from the challenges of the COVID-19 pandemic, all of us are evaluating the new parameters of our state and national economies that have experienced stimulus spending, historic inflation, supply chain disruptions, and high interest rates all in quick succession. Despite this emergence, the complete upheaval of labor, housing, and consumer markets has not meant all the pieces have returned to where they once were pre-2020.

Economist Jeff Otteau provided an in-depth analysis of NJ’s economic outlook in the months and years ahead, as well as an examination of these structural forces and their implications for real estate demand patterns in his keynote session, “Inflation, Interest Rates, and Indicators of NJ’s Post-Pandemic Economy”, at this year’s Planning and Redevelopment Conference, co-hosted by New Jersey Future and the American Planning Association NJ Chapter.

Jeffrey Otteau, Managing Partner & Chief Economist, Otteau Group Inc., speaking during his keynote session, Inflation, Interest Rates, and Indicators of NJ’s Post-Pandemic Economy, at the 2023 NJ Planning and Redevelopment Conference.

What’s Happening in the Economy?

The aftereffects of the pandemic were broadly favorable to New Jersey’s demographic and economic profile, as migration from New York City resulted in increased demand for real estate and steady job creation has returned employment to pre-pandemic levels. More recently however, the combined effects of elevated inflation and interest rates have set the stage for a reset in 2023 as the Federal Reserve Bank attempts to navigate a soft landing for the economy. “Real estate markets [will] enter a correction phase, with the [Federal Reserve] doing its level best to get that to happen. Expectation is that sometime in the near term the Fed will go through a correction phase in the NJ economy,” Otteau explained.

Otteau linked the speedy recovery of jobs to wage growth and price inflation. “We have not only recovered all the jobs we lost [due to pandemic downsizing], both locally and nationally, than we had pre-pandemic…We are up 4 million jobs nationally and 100,000 jobs here in NJ. With so many people working and collecting wages, it creates more income for spending, which feeds into inflation.” Other contributing factors to inflation include government stimulus, however much of that has been spent and accounted for, with today’s inflation most likely caused by the tailwinds of the aforementioned increase in employment. The Federal Reserve has made it abundantly clear their target for inflation is less than 2%, a goal we have not yet reached. As Otteau notes, “Inflation peaked last summer at 9% and has trailed back down to a 4% level. This has happened principally by the Federal Reserve increasing interest rates, which has slowed spending due to increased borrowing rates.” A cycle of rising interest rates is expected to lead to the contraction of the economy (nationally) by 1-2 million jobs, triggered by firms earning less profit on their enterprises due to increased borrowing costs, and ultimately a decline in consumer spending, which will aid in cutting inflation.

Another indicator Otteau examined in his plenary was the rate of construction inflation costs in NJ— both North and South Jersey experienced peaks of 17% and 20% cost increase respectively, with both brought down to approximately 3%, due to increased interest rates. (It should be noted this only means the increase in costs has slowed down, and construction costs overall have not reduced.) Rising costs of construction indicate increased costs to developers to build housing in NJ and maintain profitability, as real wages (essentially capacity for renters or buyers to meet increased rental or purchase costs) has lagged behind inflation. Home prices have remained elevated, and continue to rise, while commercial real estate is still recovering from a 40% decline in transaction volume.

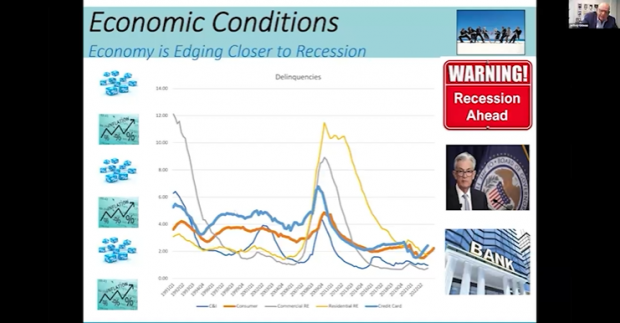

While inflation has driven up costs on borrowing and developing housing, inflation has dramatically hurt American consumers. The cost of goods and services that wages are spent on, has continually outpaced real wage increases. Paychecks, which exceeded inflation in early 2021, have not kept pace with inflation throughout all of 2022, with the gap only now beginning to close. “American consumers have responded by putting these costs on their credit cards. We now have the highest amount of credit card debt in our history, and we’re also seeing a rise in delinquency rates among credit card consumers.” This is likely to lead to credit issues and defaults in an anticipated economic downturn.

“We are likely headed for a recession later this year. Banks have taken extraordinary measures to tighten their lending stances,’ Otteau explained in preparing for rainy days ahead. The mismatch between inflation and salary increases and the pivot to credit cards to cover that gap has led to a dramatic reduction in saving rates and totals among American consumers who are running out of savings, another event that typically predicts an economic downturn or recession.

This has not translated into increased delinquency rates among NJ mortgages, with only about 1 out of every 100 homes in NJ missing three or more mortgage payments. These rates are lower than the incredibly low delinquency rate at the start of 2020 (pre-pandemic) and are wildly lower than peak delinquency rates (approximately 12%) in the wake of the 2008 Great Recession. Otteau indicates that these low observed delinquency rates can forecast a “shallow” and “short” reset in the anticipated recession.

Jeffrey Otteau, Managing Partner & Chief Economist, Otteau Group Inc., speaking during the 2023 NJ Planning and Redevelopment Conference about predicted economic conditions.

NJ Demographics

While demographic data can lag up to 2 years behind other observed trends, they still provide information in analyzing our state economy and outlook. NJ remains an outbound migration state, with 2 out of 3 people leaving NJ for a reason other than retirement, according to a United Van Lines survey of their customers. “Half of everyone who is leaving can afford to stay here in NJ…with an income in excess of $150,000. This is something we need to give attention to and think about what can be done to reduce this outflow. Nothing good comes from residents leaving by choice who are high income earners in a state,” Otteau cautioned. NJ’s current net migration rate of -49,000 people is less than the pre-pandemic peaks in the -70,000 net migration rates. “We had 91,000 people move from NY to NJ. These people were putting distance between themselves and highly densely populated areas to reduce their risk of exposure to vectors of covid transmission, rising crime rates in NYC, and taking advantage of employer policies permitting remote work.” It will be important for economists, policymakers, and researchers to keep a close eye on demographics and population data in the coming years as we continue to track the effects of the pandemic and discern temporary from permanent impacts to real estate and labor markets, and our state and national economies.

Additional alarming indicators of NJ’s economic outlook include a demographic cliff of the composition and size of households. NJ continues to hemorrhage young adults and is seeing a decline in population “under 20”. These two population segments are incredibly crucial to future economic predictions; the 24-40 year cohort represent today’s most in-demand members of the workforce, the drivers of consumer spending, and the people who will purchase and form households, engaging in the 20+ year spending habits associated with forming a family. NJ is also seeing a reduction in population under 20 years of age, which will translate into contraction of this crucial block of spenders in the 2040s.

Housing Costs and Construction Spending

The number of home sales in the Garden State has declined for 24 consecutive months, which has reversed the pandemic bump that made NJ an attractive destination to NYC households moving from the city. “Post Service reported that 500,000 NYC households filed a change of address form, with NJ being a very large beneficiary.” Home sales have declined about 40% over the past two years, in a correction phase following the pandemic. One factor is the low inventory of houses on the market — currently NJ has approximately half the available houses on the market versus pre-pandemic levels, in part due to current homeowners not wanting to relinquish favorable interest rates, keeping “trade up” buyers on the sidelines. The rental market is also showing indicators of tough economic conditions for renters. With the median apartment rental cost in NJ clocking in around $2100 / month, senior rental housing is more costly than the median, indicating a very hot market for senior rentals throughout the state. Commercial spaces also forecast a bleak picture as approximately 3 million square feet of commercial spaces in NJ have gone dark in the past year.

2022 was a bounce back year for construction spending from the decline of the pandemic, with increases in Single Family and Multi-Family Household constructions, which have rocketed to over 200% increase with over $500 million dollars spent in the first quarter of 2023 on multi-family housing. Commercial and industrial construction have contracted slightly, largely attributable to the increased costs of goods and services due to inflation. The elevated pressures of inflation is likely to cool the spike in construction spending in the residential sectors.

Outlook Ahead

“Technology cuts both ways. While technology can be exciting, it is also a big threat.” Otteau cited an Oxford Study that predicts 47% of all US jobs to be lost to artificial intelligence. Data Centers are expected to quickly come into high demand to process all of the data as technology advances and integrates even further into our economic activities, similarly the telehealth economy is expected to continue to grow, as healthcare can be provided to patients remotely. This automation push, in tandem with increased interest rates, predicts a rise in unemployment in NJ and nationality in 2023.

Otteau concluded with cautious optimism, and pointed toward public policy solutions needed to respond to broader national economic pressures. “We live in one of the most prosperous places in the country, and therefore one of the most prosperous places on the planet. We have a highly educated population and a high quality of life. We are facing economic pressures and stressors in the next 12 months, which should be short and shallow in their recession effects, with a rebound expected sometime in the next year. We have a lot of work to create a place for people and employers to locate to ensure our future prosperity.”

Related Posts

Tags: construction costs, Demographics, Development, economic outlook, economy, Housing, housing costs, inflation, planning, Population, population trends