New Jersey Future Blog

The Black-White Homeownership Gap in New Jersey

September 16th, 2020 by Tim Evans

A recent study by the real-estate firm Redfin has brought attention to the gap in homeownership rates between white and Black households. While homeownership is not necessarily the right choice for everyone, there are reasons to care about it, beyond simply putting a roof over one’s head. Homeownership is one of American households’ primary means of building wealth, because a home is the most valuable asset that most families own, and home values tend to appreciate over time. And the gap between white and Black homeownership rates indicates that this path is not necessarily equally open to everybody.

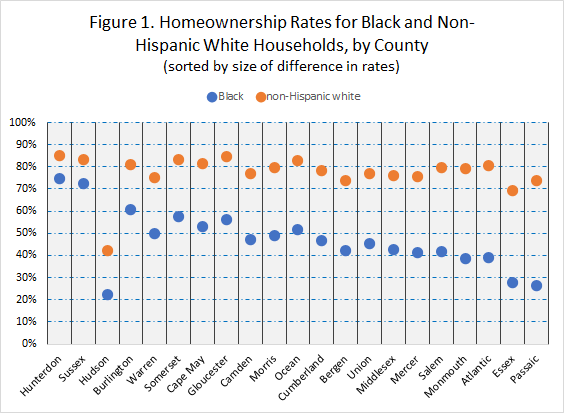

The homeownership rate for Black households in New Jersey, at 41.0 percent, lags almost 36 percentage points behind the homeownership rate for non-Hispanic white households (76.9 percent). The gap at the national level is nearly as large: 41.4 percent of Black households nationwide own their homes, compared to 72.1 percent of non-Hispanic white households.

County-level analysis in New Jersey indicates that homeownership rates for Black households tend to be highest — and tend to lag white homeownership rates by the smallest amounts — in places like Hunterdon, Sussex, and Warren counties that have high homeownership rates overall. (See Figure 1.) These places also tend to have small Black populations, however. They also tend to have housing stocks that have few options for renters, meaning that most households that can afford the price of entry — irrespective of race — are going to be homeowners by default. Such places price out more non-white households than white ones, since non-white household incomes tend to be lower (in New Jersey, median household income for white households is $85,423; for Black households, it is $51,309). In these counties, a relatively high Black homeownership rate is not necessarily the good news that it superficially appears, being more a function of a small denominator (few Black households overall) than of a large numerator (large numbers of Black homeowners).

Results at the municipal level are more informative. Here, the smallest disparities between the Black and non-Hispanic white homeownership rates tend to be found in places with low homeownership overall, the reverse of what was true at the county level. Hudson County was an exception to the broader county pattern, with a relatively small gap between Black and white homeownership rates but with low homeownership rates for all races. But the pattern in Hudson County turns out to be more typical of the municipalities where most of the state’s Black households live, with more diverse housing stocks, more diverse populations, and greater numbers of renters. It is also true that these places with smaller Black/white homeownership disparities and higher Black population percentages tend to have lower home values, hinting at the lingering effects of past discriminatory practices—redlining, restrictive covenants, racial steering by real estate agents, as well as the ongoing phenomenon of exclusionary zoning—cited by the Redfin study as contributing to the homeownership gap. Having been effectively excluded from whole sections of the state, non-wealthy, non-white households end up concentrating in a relatively small number of places with more diverse housing stocks but where values tend to be low.

The geographic patterns of disparity between white and Black homeownership rates are not an accident; they are the artifact of a history of racial discrimination and segregation that New Jersey needs to confront. Understanding where – and why – the disparities are greatest or lowest can point toward housing strategies that can expand opportunities for everyone, putting New Jersey on a path toward becoming a more equitable and inclusive state.

See the full analysis here.

Related Posts

Tags: black and white homeownership, equity, homeownership, Housing