New Jersey Future Blog

Why NJ Should Tie Business Incentives to Smart Growth

April 26th, 2011 by Jay Corbalis

Panasonic Chief Executive Officer Joseph Taylor signs the lease agreement to bring the corporation's North American Headquarters to Newark, Wednesday, April 20, 2011. Source: Panasonic

The following op-ed by New Jersey Future Executive Director Peter Kasabach appeared in the Corner Office section of this week’s edition of NJ BIZ:

New Jersey is poised to hand out $137 million in tax credits to two companies — Panasonic Corp. and Bayer HealthCare — that recently announced plans to relocate their headquarters in the Garden State. Panasonic stands to gain $102 million by moving its North American headquarters from Secaucus to Newark. Bayer will receive $35 million by consolidating its entire East Coast business in a single New Jersey location to be determined.

Spending State Money to Keep Business

Is this money well spent? That depends on whom you ask. Newark officials certainly think the incentive offered to Panasonic is a wise investment. But in Secaucus, Panasonic’s current landlord, Hartz Mountain Industries, has filed an appeal to stop the state from issuing a tax credit for the move. State support for Bayer’s consolidation will no doubt be welcomed in whichever town the pharmaceutical giant chooses as the site of its new headquarters. But in three New Jersey communities that are now home to Bayer facilities — Wayne, Montville and Morris Township — the company’s receipt of a state subsidy to consolidate its operations elsewhere may be greeted with less enthusiasm.

It would make sense for the state to establish a hierarchy of business incentives based, in part, on where the business in question is proposing to locate.

From the state’s perspective, offering tax incentives to companies that either create jobs in New Jersey or choose not to move them to another state is an important economic development strategy. But from one town’s perspective, state tax policy that may encourage a company to move to another town is the ultimate in fiscal injustice. How can these sometimes competing interests be balanced? One way is for the state to more closely align its business attraction and relocation strategies with its land-use policies. New Jersey wants its established cities and towns to retain their economic vitality by attracting new development, and promoting redevelopment, where infrastructure already exists. At the same time, the state wants to preserve open space and protect environmentally sensitive areas by restraining growth in places where it is not appropriate.

Linking Incentives with Smart Growth

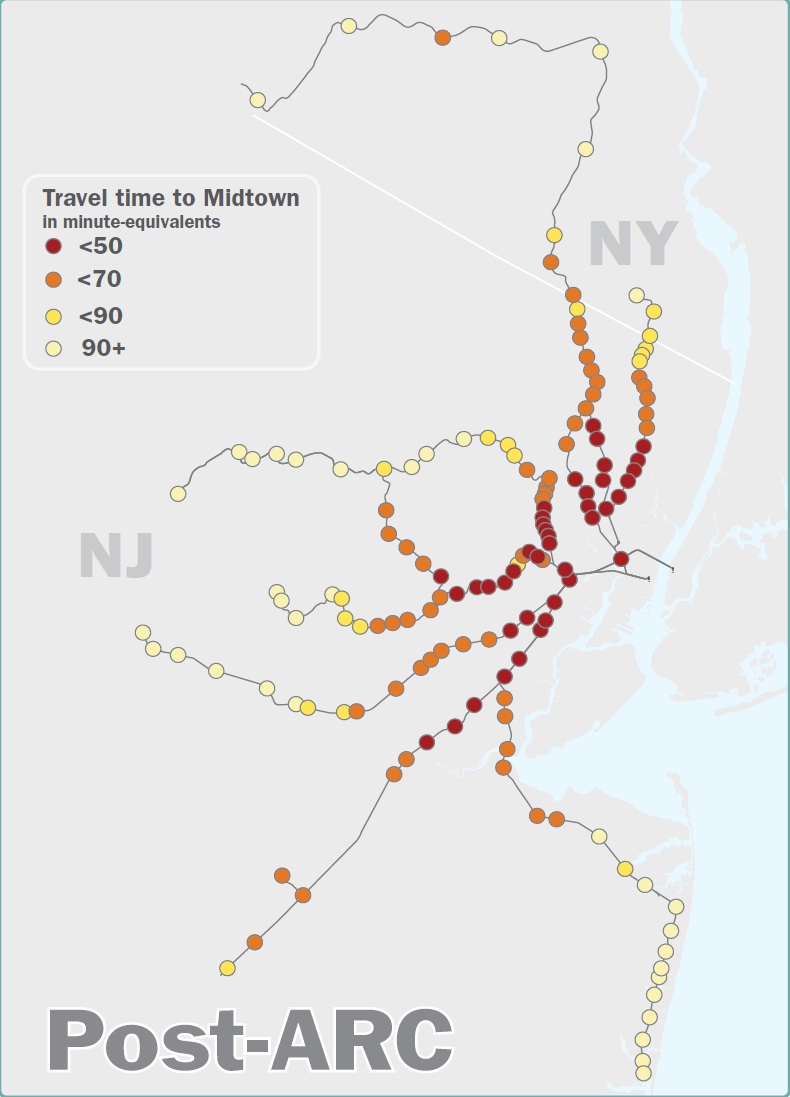

It would make sense, then, for the state to establish a hierarchy of business incentives based, in part, on where the business in question is proposing to locate. If, for example, a company wants to build a shiny new headquarters in the middle of a cornfield that has no housing nearby, is not located near existing sewer service and can be reached only by car, it should not be rewarded with a bountiful state subsidy. If, on the other hand, a company wants to renovate an existing building in an established downtown within walking distance of housing and transit, it should merit a healthy financial incentive. There will be any number of examples, of course, that fall between these two extremes. Bayer is reportedly looking at several suburban locations, including at least one that involves retrofitting an existing building and anchoring a larger mixed-use development. The retrofit and mixed-use development should earn the company a larger incentive than it would receive for new construction, but its suburban location should warrant less credit than it would get if it located in, say, downtown Paterson — or even in closer proximity to a train station outside an urban setting. Several of New Jersey’s pressing problems — rising gasoline prices, worsening traffic congestion, disappearing open space — would be mitigated if we were to reverse the decades-long trend of people moving farther away from where they work, and becoming more dependent on the automobile.

Connecting housing with jobs, and making both more accessible to transit, should be a high priority in the years ahead, and the state’s business attraction and relocation strategies should reflect this. When it comes to dispensing precious financial incentives, the state should discourage companies from perpetuating the problems of the past, and reward companies that will make New Jersey a better place to live and work in the future.

Related Posts

Tags: Employment, Governor, Redevelopment, Smart Growth, State Planning, TOD, Transportation

The problem with this tract is that it makes too much sense to work in New Jersey because of the provincial mentality that is pervasive here.