New Jersey Future Blog

A Bleak Recent Past, a Brighter Future Ahead

March 31st, 2011 by New Jersey Future staff

- From the third quarter of 2009 to the third quarter of 2010, personal income in the United States grew by 3.6 percent and wages and salaries by 2.8 percent, but the growth was not as robust (2.7 percent and 1.7 percent, respectively) in New Jersey.

- The median annual household income over the last five years has been 34 percent higher in New Jersey than the nation as a whole ($68,981 to $51,425), but the median annual cost of home ownership has been 55 percent higher ($27,552 to $17,832).

- The combination of sluggish income and wage growth and high housing costs has slowed New Jersey’s recovery from the Great Recession, but the outlook for 2012 and beyond is brighter — with the economy stabilizing, mortgage lending loosening and a Generation Y home-buying surge poised to begin in 2016.

- The kinds of homes Generation Y will be looking to buy will be driven by changes in household size and composition, as more single homebuyers and childless families will favor smaller, more compact development that is close to work, shops and entertainment.

Experts See New Jersey in Transition

Joseph Seneca, university professor of economics at Rutgers’ Bloustein School of Planning and Public Policy, and Jeffrey Otteau, president of Otteau Valuation Group, joined forces at New Jersey Future’s sixth-annual Redevelopment Forum on March 4 to paint a picture of the Garden State in transition — from a manufacturing and construction-based economy to a services-based economy, from a state in deep recession to a state in slow recovery, from a Baby Boomer-induced growth pattern of suburban sprawl to a Generation Y-inspired comeback for compact, walkable communities.

Good News, Bad News on Economy

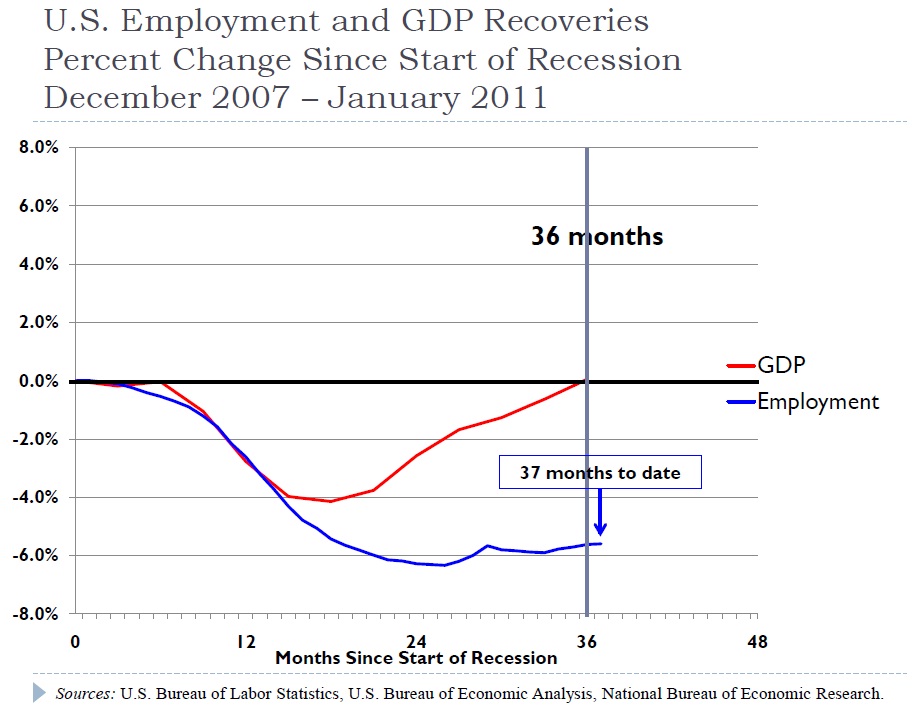

Seneca’s presentation featured the good-news, bad-news nature of today’s economic climate. While the nation’s GDP had finally recovered to pre-recession levels by January 2011, employment had not, still falling below December 2007 levels by nearly 6 percent. Private-sector employment in New Jersey, after rising fairly steadily from 1998 to 2007, plummeted in 2008, showed a brief rebound in the first half of 2009, then dropped precipitously for the remainder of the year. In 2010, while U.S. private-sector employment grew every month from March through December, New Jersey’s experience was mixed; the state gained 8,800 private-sector jobs in April 2010, lost 8,800 in September, gained 10,300 in October, then lost 13,300 in December. Total private-sector employment in New Jersey was exactly the same in December 2010 (3.2 million) as it was in March 1998.

Real Estate Rollercoaster

Otteau’s presentation focused on the impact these economic factors have had on the state’s real estate market. Demand for housing dried up when the recession hit, only to rebound dramatically when homebuyer tax credits were offered from May 2009 to April 2010. Sales abruptly slumped again after the tax-credit program expired. About 15 percent of New Jersey homeowners are saddled with “negative equity” (a mortgage that is larger than the home is worth), more than 7 percent below the national average but 8 percent above the corresponding percentages in Pennsylvania and New York. New Jersey home prices, after showing declines ranging from 11.9 percent in the first quarter of 2009 to 6.2 percent in the last quarter, actually rose by an average of 1 percent in each of the four quarters of 2010.

Demographic Changes Kick In

As the economy improves, and a number of demographic changes start to kick in, the real estate market will undergo significant change, Otteau predicted. With the recovery in full swing in Manhattan, jobs have nearly recovered and housing is looking up, which will generate overflow demand in New Jersey. The nation’s population will grow by 100 million by 2040, with six out of every 10 new Americans living in 20 regional markets where employment, education, civic and recreational attractions combine to serve the region’s population and economic activity; New Jersey lies strategically at the heart of the Mid-Atlantic market.

Generation Y’s Housing Preferences

Generation Y, which will go on a home-buying surge from 2016 through 2018, wants to live in walkable, mixed-use communities, Otteau asserted, citing RCLCO Consumer Research. Driven by convenience, connectivity and a healthy work-life balance to maintain relationships, one-third of Generation Y consumers surveyed said they will pay more to walk to shops, work and entertainment; two-thirds said that living in a walkable community is important; more than half said they would trade lot size for proximity to shopping or for work; and even among those with children, one-third or more said they are willing to trade lot size and “ideal” homes for walkable, diverse communities.

All of which bodes well for redevelopment in New Jersey. After four decades of under-building in urban centers, with market conditions stabilizing, with construction financing becoming available and homebuyer and renter preferences shifting toward smaller places, the ground for redevelopment is fertile. And redevelopment projects will sprout from this ground, not only because government policies and programs plant and nurture them, but because the market demands them.

Related Posts

Tags: Events, New Jersey, Redevelopment, Smart Growth, TOD

[…] Read Full Article This entry was posted in Interesting NYC real estate articles. Bookmark the permalink. ← Everything You Need to Know About Israeli Investment Right Now […]

[…] Read Full Article This entry was posted in Interesting NYC real estate articles. Bookmark the permalink. ← Everything You Need to Know About Israeli Investment Right Now Antiques Stores Awaiting Rebound in Nyack → […]